Part-Time Money Laundering: The Student ‘Job’ to Avoid

With January well and truly over and the start-of-the-year maintenance loan payment seeming like a distant memory for a lot of university students in the middle of the academic term, many people in full-time education may be thinking about earning money on the side to supplement their living costs, if they’re not in part-time work already.

While things like waiting tables or working at a supermarket checkout may not seem like glamorous jobs, they’re popular choices for students because of the flexibility offered when balanced with lectures, as well as the lack of experience required to get them.

However, there is a darker side to the student job market. Recently, job advertisements claiming to offer quick, easy money have been increasing in number – and with some serious consequences.

Young people – and in particular students – are frequently becoming targets of money muling: a type of money laundering where money is moved through a victim’s bank account. Rather than transferring funds themselves, using a mule enables criminals to distance themselves from the crime, making it more difficult for laundered money to be traced back to them.

How it works

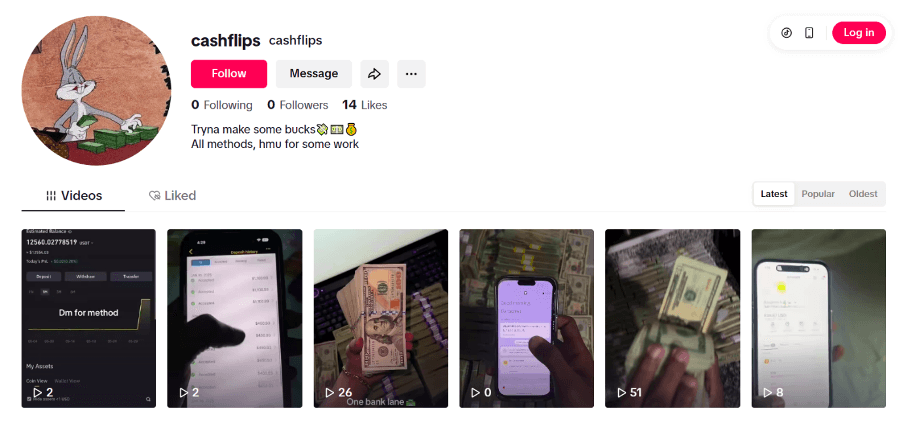

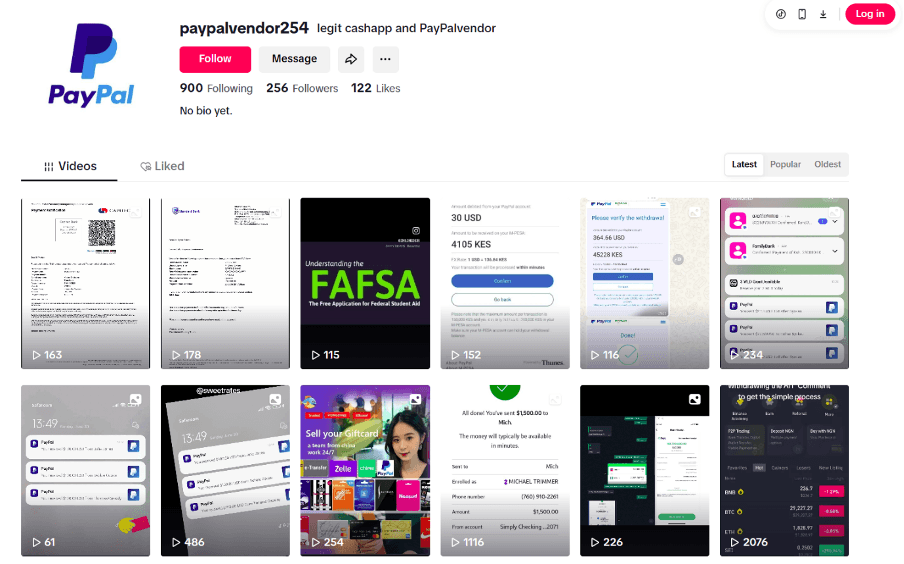

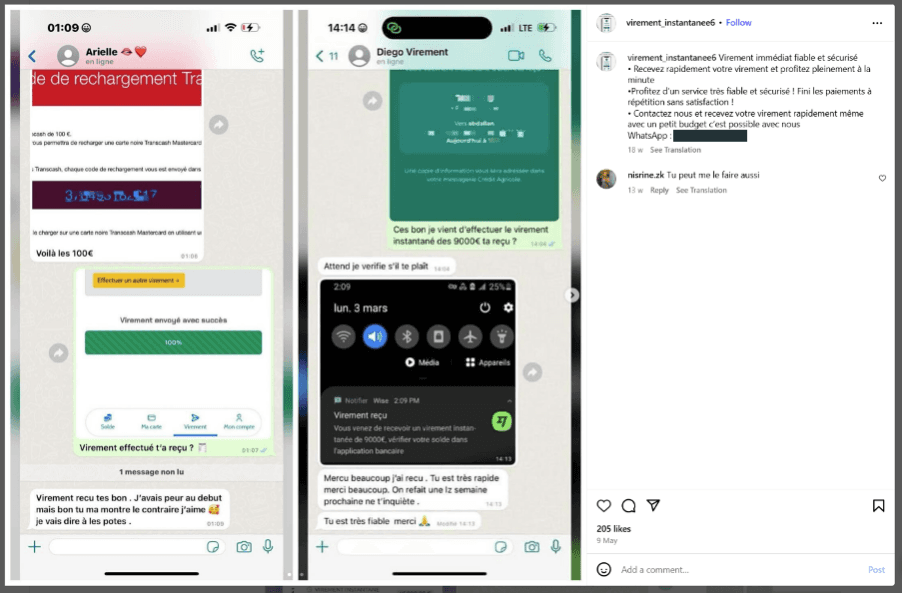

Criminals frequently recruit victims online, most notably through social media. Common features of profiles that recruit money mules include:

Claims that they can help people make large amounts of money quickly, often from home.

Claims to be a vendor, broker, or ‘money transfer agent’, sometimes for a specific bank or payment platform.

Bios or posts that mention ‘money flips’ or ‘cash flips.’

Photos depicting piles of cash or luxurious lifestyles funded by the money they’ve received.

Screenshots of bank transfers involving vast sums of money to appear more legitimate.

Once the victim engages with the criminal, they are asked to hand over their bank details to allow money – which has been obtained illegally – to be moved in and out of their account, thereby becoming a mule. In return, the victim is given a cut of the money, which is what makes the offer appear so appealing.

Figure 1. A generic money mule recruitment profile on TikTok that advertises ‘all methods.’

Figure 2. A mule recruitment profile on TikTok claiming to be a vendor for PayPal.

Figure 3. A mule recruitment profile on Instagram targeting victims with French bank accounts.

While some money mules are aware that what they’re doing is a crime, others may not realise it until it’s too late. In the UK, becoming a money mule can carry a penalty of up to 14 years in prison, and lead to the closure of one’s bank account as well as difficulties applying for credit.

Student recruitment and postal mules

Lured by promises they can make a lot of money in a short amount of time, students are often prime targets for money mule recruiters as they are younger, more vulnerable, and less likely to have as much disposable income. According to Cifas, in the first half of 2024 nearly 50% of UK money mule cases involved 21 to 30-year -olds. In a separate report by the UK government, throughout the whole of 2024 an estimated 23% of money mules were under the age of 21.

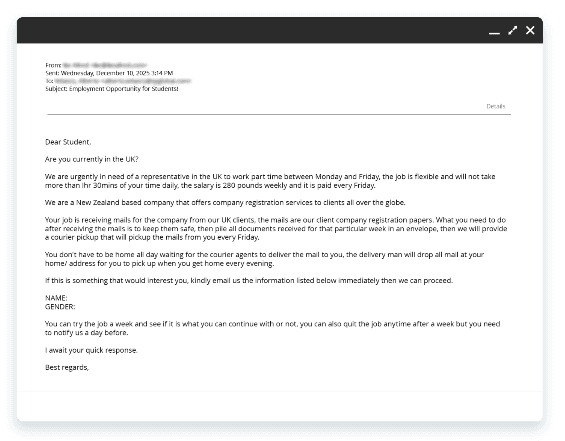

However, money muling can take many forms; students are not only targeted via social media, and neither are they always asked for control of their bank accounts.Often, money mule recruitment can be disguised as a job offer, and there have been cases of students receiving unsolicited emails to their university email address regarding part-time work that involves transferring physical documents. Below is one such example that ended up in the inbox of a Netcraft staff member while they were a student – note how the fraudster says that students can receive post to an address that is then picked up by a courier:

Figure 4. An email from a mule recruiter that was sent to a university email address.

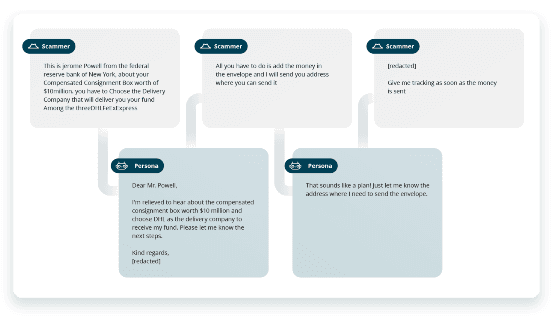

Unsurprisingly, it's unlikely that the documents referred to in the above email are really ‘company registration papers.’ In fact, similar conversations between criminals and our Netcraft Scam Intelligence personas would suggest that ‘documents’ like this could be cash, transfer slips, or other means of payment. In one conversation with a fraudster who was impersonating the Federal Reserve’s Jerome Powell, one of our personas was asked to send cash to an address in the UK, possibly belonging to a mule:

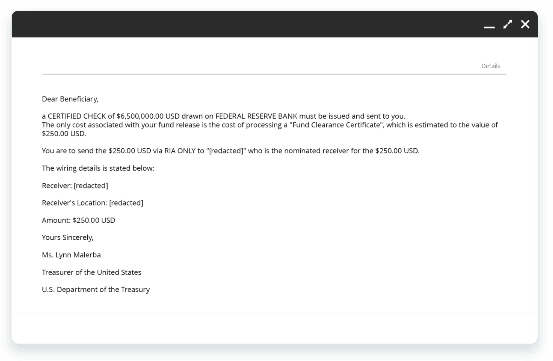

Another scammer posing as American public official Lynn Malerba wanted payment via Ria transfer to a recipient in Louisiana:

Furthermore, it can be harder for people to recognize if they’re being targeted as a money mule when the request comes from someone they know. In one case, a student at a UK University was asked to launder money by a family member in exchange for designer goods.

Improvise, adapt, mislead.

It’s not just the temptation of easy money that leads to people participating in money laundering: recently, we got first-hand insight into just how quickly scam victims can also wind up becoming a money mule at the same time.

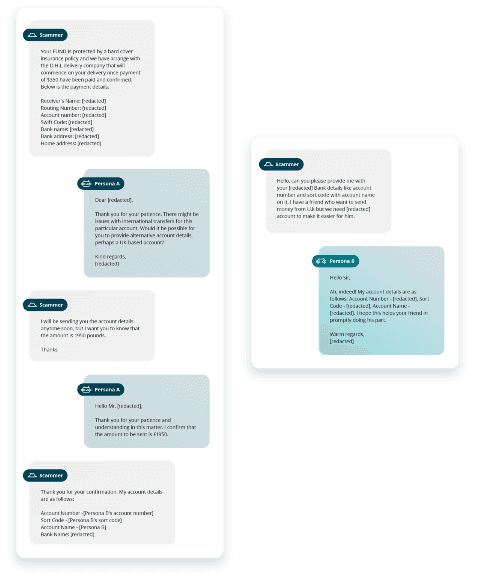

In a particularly interesting exchange, one fraudster ended up in separate conversations with two of our personas. When Persona A requested a UK account from the fraudster (which the fraudster did not have) in which to supposedly deposit money, the fraudster asked Persona B to provide their bank details, disguising it as a favour for a friend, before passing on said details back to Persona A. Not only was Persona B getting scammed, but they were being tricked into becoming involved in money laundering in the process.

NB: For the avoidance of doubt, all bank account details provided by Netcraft Scam Intelligence personas are fake, and Netcraft has not taken or attempted to take any money from victims.

This is only one example that illustrates how easy it is for people to become unwitting money mules without fully realizing what it is that they’re doing.

The bottom line is this: if anyone asks you for access to your bank account, or to move money or documents around – whether it’s a stranger or someone you know – stay away, no matter how tempting the reward might seem. If something seems off, that’s because it usually is, and you could end up committing a criminal offense.

And to any students looking for part-time work, we’d suggest you stick to vetted internships, retail jobs, or bartending – there are far fewer risks involved.

Join our mailing list for regular blog posts and case studies from Netcraft.